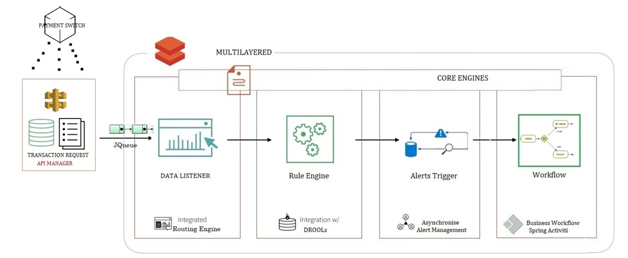

Kognitive Enterprise Fraud Management Solution is a real-time intelligent solution that combats sophisticated fraud in real-time. It monitors suspicious activities in real-time, and ensures that right decisions are taken at the right time. Kognitive EFM is designed to meet fraud detection, investigation, prevention, monitoring compliance, and audit needs of banks.

KEFM provides an electronics barrier for any type of fraudulent transactions emanating from any online channel, enabling enterprises to accept more orders, and help protect and grow businesses. KEFM detects a full range of payment fraud for any business and industry. Our real-time machine learning powers automated decisions to stop fraudulent behavior proactively and stay ahead of emerging trends. KEFM provides your team with sophisticated tools needed to detect fraud and work more efficiently.

Core banking is one of the most important channels for banking since the bulk of highvalue transactions pass through it. Most of the core-banking transactions are monitored postfacto that leaves enough room for fraudsters to get away with the fraud. KEFM Real-time Transaction Monitoring solution protects banks against core-banking frauds like customer, account and employee level frauds. It makes use of real-time intelligence and predictive analytics to detect and stop/hold suspicious transactions as they happen in the core banking system.